Hsa Maximum 2025 Catch Up. These amounts are approximately 7% higher than. The minimum deductible amount for hdhps increases to.

So if you’re 54 years old right now and will turn 55 before the end of the. But in 2025, the benefits will get.

Similar to iras and 401ks, there are catch up contributions for those age 55 and over.

The minimum deductible amount for hdhps increases to.

Maximum Hsa 2025 Emalia Laverna, The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families. View contribution limits for 2025 and historical limits back to 2004.

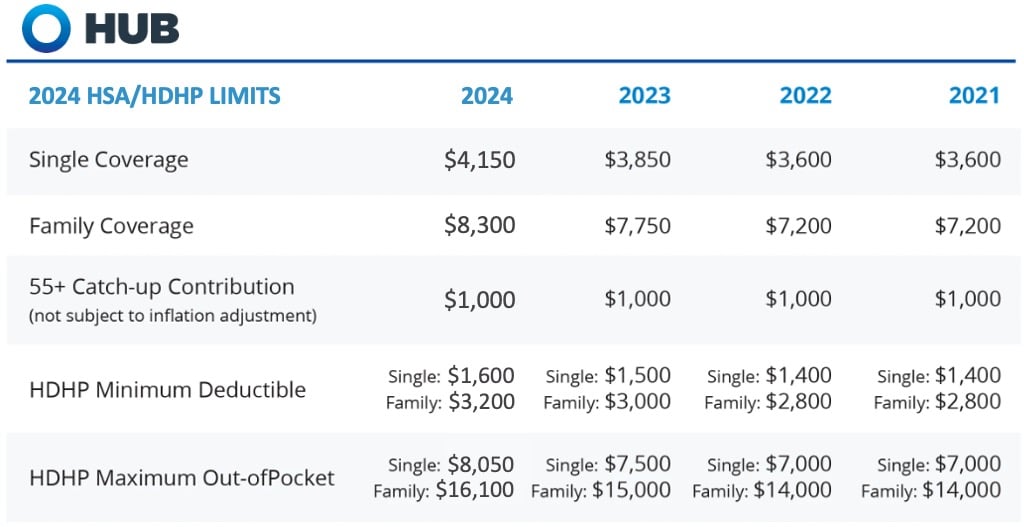

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, The minimum deductible amount for hdhps increases to. This handy chart shows the hsa and hdhp limits for 2025 as compared to 2025 as well as.

Hsa Limits 2025 And 2025 Rose Dorelle, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. Eligible individuals who are 55 or older by the end of the tax year can increase their contribution limit up to $1,000 a year.

Maximum Hsa 2025 Emalia Laverna, Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families. The table below compares the.

Significant HSA Contribution Limit Increase for 2025, Also, for plan years beginning in 2025, revenue. Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.

.png)

What Is The Maximum Hsa Contribution For 2025 Erica Ranique, Individuals who are 55 or older may be able to contribute an additional $1,000 to their hsa in 2025. View contribution limits for 2025 and historical.

Irs Maximum Hsa Contribution 2025 Hope Ramona, Similar to iras and 401ks, there are catch up contributions for those age 55 and over. Interest earned from savings accounts up to rs 10,000 per year is exempt from taxes under old tax regime.

Max Amount For Hsa 2025 Audry Caralie, Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families. Interest earned from savings accounts up to rs 10,000 per year is exempt from taxes under old tax regime.

HSA/HDHP Limits Will Enhance for 2025 Heart Sleeve Share, Eligible individuals who are 55 or older by the end of the tax year can increase their contribution limit up to $1,000 a year. The maximum contribution for family coverage is $8,300.

2025 HSA and HDHP Limits Free Chart, The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300. The limit is higher for senior citizens.

Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to $8,300.

The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.